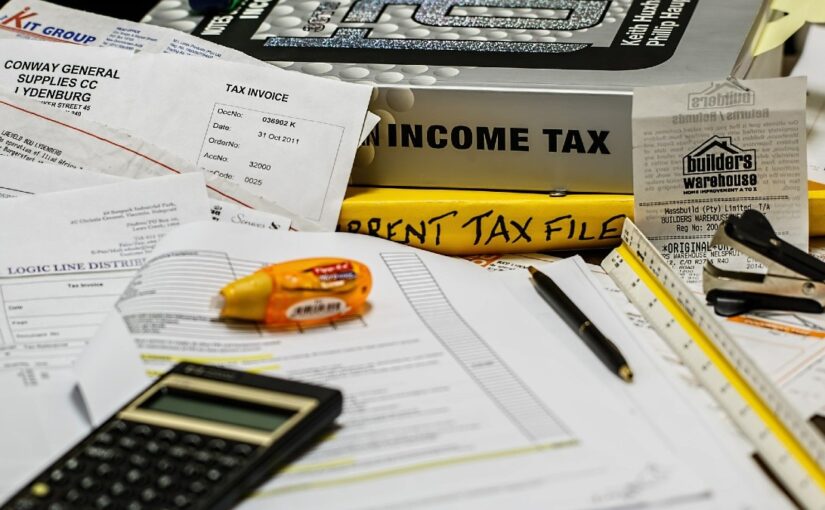

CBDT gives taxpayers a sigh of relief amid the pandemic and extends the income tax filing date of FY2018-19 and FY2019-20.

In a big relief for tax payers, income tax return date for annual year 2018-19, 2019-20 has been extended due to the outspread of Coronavirus. CBDT revealed that the extension of two months comes at a time when the government is looking to mitigate the hardships of the taxpayers.

On July 29, Central board of Direct taxes (CBDT) further eased the burden on taxpayers by extending and raising the deadline for filing of original income tax returns for FY19 till September 30.

“In view of the restrictions due to the coronavirus pandemic CBDT has also extended due date for filing of IT for FY 2018-19 (AY 2019-2020) from July 31 to September 30. Earlier, this date was extended from March 31 to June till July 31,” said IT Department in a tweet. Notification for the same has been issued, after the Finance ministry announced relaxations for the same on June 24.

In the June extension, date for taxpayers who self-assessment tax liability is up to rupees 1,00,000 has also been extended upto 30th November 2020 in order to to provide relaxation two small and middle class taxpayers. However, no relaxation has been given to taxpayers whose tax liability exceeds rupees one lakh.

On the other hand, CBDT noted that reduced rate of interest of 9% shall not be applicable for the payments made after June 30, 2020 as specified in the ordinance.

Here are the steps you can follow to file income tax returns for FY 19:-

– Register using your Permanent Account Number (PAN), it will serve as the user ID.

– Go to e-filing under the relevant assessment year and select the appropriate Income Tax Return (ITR) form.

– Download ITR-1’s return preparation software if you are a salaried individual.

– Open the Return Preparation Software (excel utility) that you have downloaded, follow the instructions and enter all details from your Form 16.

– Compute tax payable, pay tax and enter relevant challan details in the tax return. If you do not have a tax liability, you can skip this step.

– Confirm the details entered by you and generate an XML file, which is automatically saved on your computer.

– Go to the ‘Submit Return’ section and upload the XML file.

– You can digitally sign the file on being prompted. If you do not have a digital signature, you can skip this step.

– A message confirming successful e-filing will be flashed on your screen. The acknowledgement form – ITR-Verification is generated and the same can be downloaded. It is also emailed to your registered email id.

You can e-verify the return through any one of the below six modes:

1) Netbanking

2) Bank ATM

3) Aadhaar OTP

4) Bank Account Number

5) Demat Account Number

For more information, please login at the official website www.incometaxindiaefilling.gov.in for filing your Income tax return.

Also Read: Rhea Chakraborty harassed Sushant Singh Rajput, says Pavitra Rishta actor Ankita Lokhande